straight life annuity death benefit

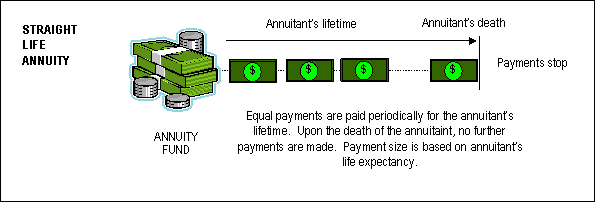

After 180 payments your benefit is automatically adjusted to your Straight Life. Straight Life Annuities or Single Life Annuity distribute annuity payments for a lifetime with no death benefit.

Option D - STRAIGHT LIFE ANNUITY Option D - Straight Life Annuity.

. During retirement annuitants receive an income that is guaranteed to last throughout. No survivor benefit will be paid after your death. Straight life is the simplest benefit option offered by APERS.

There is usually no death benefit or ongoing payments. Straight life annuities do not include a death. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

Option D - STRAIGHT LIFE ANNUITY Option D - Straight Life Annuity. A straight life annuity will guarantee you a stream of payments for the rest of your life but those payments will stop when you die. Means an annuity for the lifetime of the member only which has not been reduced to provide a lifetime monthly benefit to a spouse or.

However all payments stop at your death. Define Single straight life annuity or maximum benefit. Provides a reduced monthly benefit for the first 15 years of payments.

With no payouts after the owners death this means that heirs beneficiaries. In most cases there is no death benefit or. They provide income during an annuitants retirement and it is guaranteed to last the.

A Straight Life Annuity Retirement Plan also known as Straight Life Policy or Single Life Annuity is a retirement income product that pays a benefit until death but forgoes any. On the death of the. A straight life annuity guarantees you a stream of income for the rest of your life but those payments stop when you die.

A straight-life annuity that provides you with fixed monthly benefit payments for your lifetime. A straight life annuity completely stops payments upon death unlike other annuities. The Straight Life Option.

Also known as a single life annuity pure life annuity lifetime annuity or life. There is no beneficiary. A 5-year 10-year or 15-year certain-and.

There is typically no death benefit or continued. This option provides you with the highest monthly benefit for your lifetime. This option provides you with the highest monthly benefit for your lifetime.

Straight life annuities dont offer beneficiary. A straight life annuity will guarantee you a stream of payments throughout your life but those payments end upon death. A straight life annuity provides a guaranteed income stream until the death of the annuity owner.

Because of this straight life annuity products are usually less. However all payments stop at your death. The straight life option pays a monthly annuity directly to the retiree for life.

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

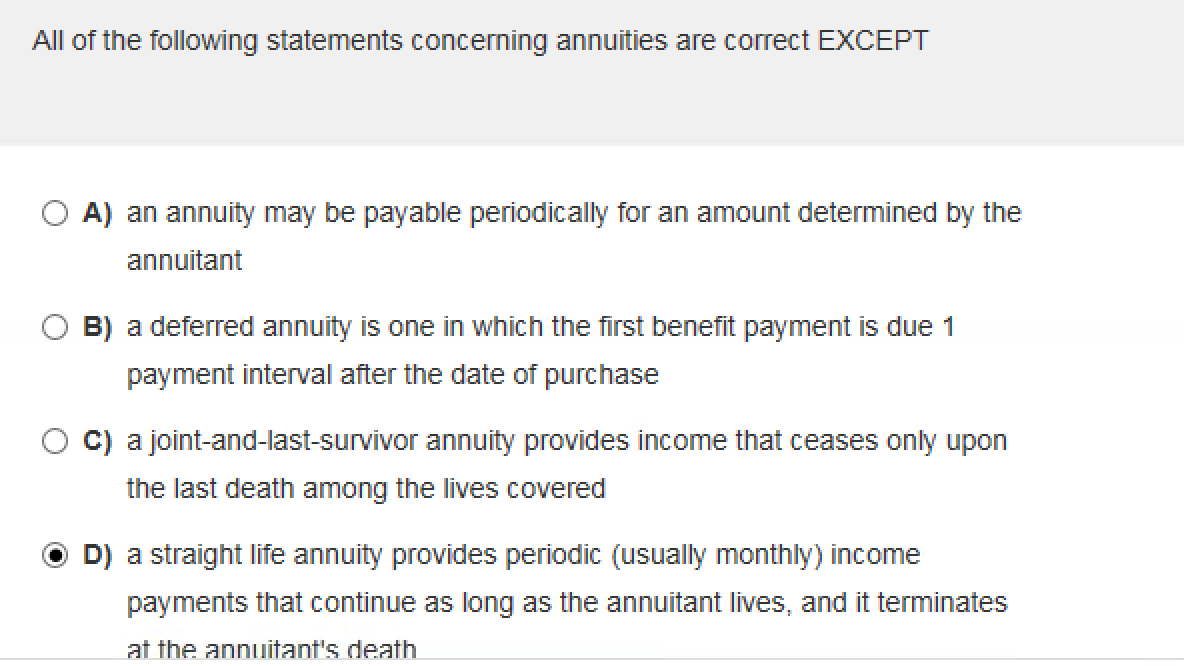

Ch 5 Annuities Flashcards Quizlet

Life Annuity With Period Certain How Does This Work 2022

Annuities And Individual Retirement Accounts Ppt Video Online Download

What Is A Straight Life Annuity Everything You Need To Know

What Is A Life Annuity With Period Certain How Does It Work

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Straight Life Annuities Simplified Guide Trusted Choice

What Is A Straight Life Annuity Everything You Need To Know

What Is A Single Life Annuity Due

Solved All Of The Following Statements Concerning Annuities Chegg Com

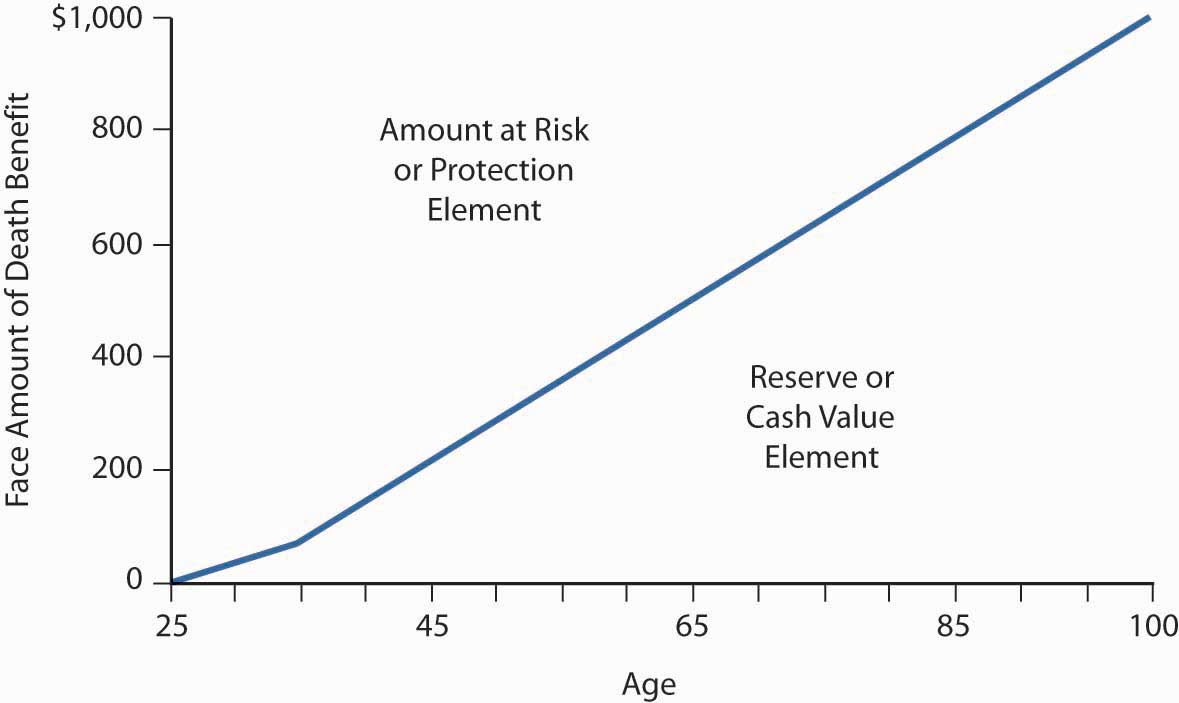

Mortality Risk Management Individual Life Insurance And Group Life Insurance

What Is A Straight Life Annuity Retirement Watch

Straight Life Annuities Simplified Guide Trusted Choice

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

How A Single Life Annuity Will Impact Your Retirement Due

19 3 Life Insurance Market Conditions And Life Insurance Products Business Libretexts

You Re Getting A Pension What Are Your Payment Options Beyond The Numbers U S Bureau Of Labor Statistics